Impact of Coronavirus Pandemic: Aspects to Marketing, Ecommerce and Advertising

The life-changing coronavirus is ruling our life and every moment we live. Our priorities and style of living have also changed according to the pandemic situation. If we look into the changes made for the coronavirus pandemic, we can see an eye-tickling shift in marketing, ecommerce and advertising platform aspects. When you are working on these platforms, you always need to be up to date with changes.

Here we represent the most impactful and valuable beginning of the big circle of change we are waiting to explore.

Quickest drop in the advertising budget

A most recent report of the Marketing Week study from the Q1 2020 IPA Bellwether led to the brief that UK advertising has been declining fast since the last recession.

The coronavirus causes a sudden transfer in spending in the market industry. Companies have dropped their marketing budgets at a net balance of -6.1% throughout Q1, which seems to be +4% in Q4 2019.

The most affected category is marker research, with a net balance of 21% cut budget, while public relations (-14.3%) and events (-15.9%) were also massively affected. Among the seven growth types, marketing (-6.6%) and promotions (-7.2%) were the least impacted.

14% of marketing campaigns continued as plan

There is a sharply defined change in marketers’ response in Marketing Week’s second study compared to the first. The scenario of 31st March described that campaigns are being delayed or reviewed by 86% of UK-based marketers. Only just 14% are continued as planned.

Organisations are now preferring digital products and content as their new marketing strategy. In light of covid19, 62% of marketers had changed their marketing strategies, and 18% have done this only in a week. 85% of organisations claimed that they are delaying and reviewing new hires. 90% are doing the same with budgeting commitments. A sharp rising of 41% and 61% have been noticed.

Since mid-march, a sharp increase in organisations has been noticed. Coronavirus is forced to do so. It can be assumed that marketers will continue making the changes with preplanned hires, campaigns, hires and budgeting.

69% demand drop in the market

The same Marketing week study shows that 69% of UK organisations are experiencing a demand drop for their products and services. This scenario increases to 77% for SMEs. It is clear that smaller companies are having more trouble.

Since 16th March, marketers from all organisations experiencing a rise in requirements for remote work from 57% to 72%. While the number of claiming marketers is very small, believing remote working can affect productivity.

Fast-moving consumer goods and retail

Increase in hammocks online sale up to 1,292% YoY

In online sales of hammocks and barbecues, retailers see a 275% and 1292% year-on-year growth, respectively (to 22nd April), according to Emarsys’ cooperation with GoodData. A vast increase in football purchases of 1,870% was also traced at the same time last year.

Lawnmowers and flip-flops have met a three-digit increase in sales in the previous lockdown in summer. According to Emarsys, customers depend more and more on online retailers for the closure of physical stores.

Primark sales drop from 650 million to zero

The fashion giant Primark has reported its international revenue has declined from an average of 650 million per month to zero since mid-march. The retailer was forced to close all global stores by 22nd March due to imposed lockdown and social distancing.

Primark has agreed to accept an additional $370 million worth of stock, having been handed over by suppliers by 17th April, and to take on the responsibility of a fund to ensure overseas factory employees continue to get paid.

5.1% downward YoY growth in UK eCommerce

According to the Retail Gazette report, UK ecommerce growth dropped by 5.1% year-on-year in March. Here the brutal hit comes upon fashion, falling by more than 23%. At the same time, month-on-month growth increased by 2.6% compared to February 2020. Ascribed to a period of warmer weather throughout March, sales of gardening tools and supplies increased by over 94%.

Customers have put money into electronics products like TVs and game consoles, office equipment for home setups, and sales afloat up 40%. Beauty product purchases also increased as people occasionally treated themselves as a part of the entertainment.

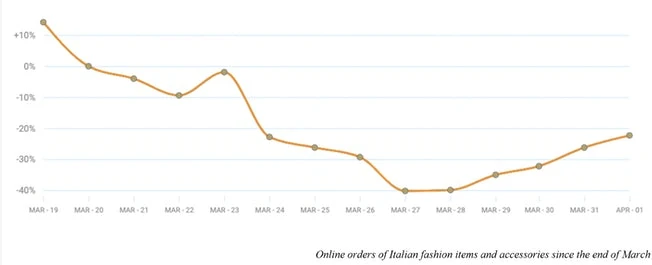

18% Increase in Italian fashion purchases

In Italy, online fashion orders have increased by 18% from 28th March to 1st April. In this sector, a 13% increase in revenue is also traced from Emarsys’ daily COVID19 Commerce Tracker.

Being the most terrible affected country in the world, Italian fashion retailers have seen a 40% fall in orders of fashion products for the last two months. 26% down in revenue is also reported over the same period.

Compared to UK, US and France, Italy faced the biggest fall in fashion. As the lockdown is beginning to ease, consumers are starting to purchase non-essential items, but the recovery is still slow, and it seems to be steady.

The remarkable change in disposable gloves and bread makers’ eCommerce category

According to the data from Stackline about the fastest growing and declining ecommerce categories in the US, disposable gloves are at the top of the growth list with a 670% rise in ecommerce sales this month compared to march 2019. Bread machines came to second place with a 652% growth rate.

Other popular items are cough and cold products with more than 535% growth rate, long-lasting foodstuffs with more than 397%, dried rice with more than 386% growth rate, weight training equipment with more than 307% growth and dishwashing supplies with more than 275% growth rate as well as.

On the other side, the largest decline was experienced by suitcases and briefcases with a 77% drop. Along with cameras experienced -64%, men’s swimwear also -64% and bridal -63%, as the outing for holidays, weddings and excursions are postponed.

UK supermarket’s busiest month with a 20.6% rise in sales

During March, the public spent $10.8 billion on groceries, even more than at Christmas. In the grocery market, 7.6% year-on-year growth was extended throughout Q1 2020. The busiest week starts on 16th March for grocery shopping. Between Monday to Thursday, 88% of households make five shopping trips to supermarkets, and the spending was around 42 million during this short time.

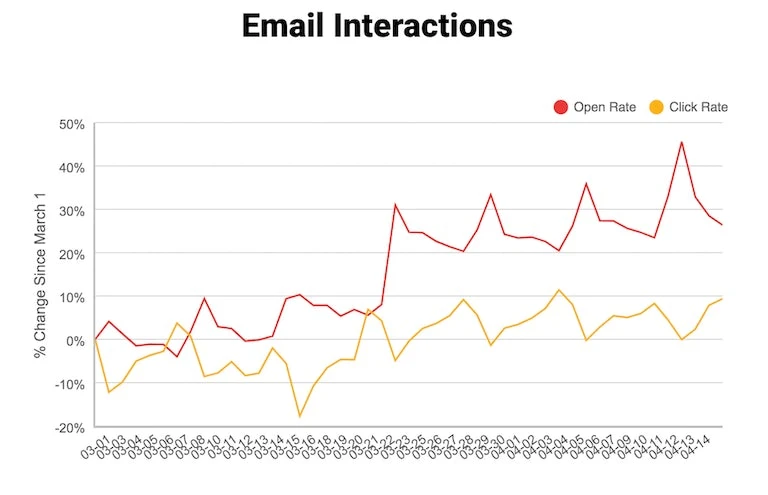

Retail email open rates are 40% higher

BounceX study suggests that email open rates are 40% up on 14th April than 1st March. However, conversation and website visit rates have been studied and are 10 to 20% lower than what we saw before 1st March.

UK retail industry forecast of losing 12.6bn

According to a new forecast by GlobalData published on 24th March UK retail industry will see a loss of 12.6bn this year. Footwear and clothing brands are predicted to face the most prominent sales decline of 20.6%. On the other hand, the food and grocery markets are forecast to grow by 7.1% in 2020.

Advertising

10% drop in ad revenue

According to Guardian, a 10% drop in ad revenue was expected by British broadcaster ITV during April. The drop in ad revenue in March was more severe than originally predicted initially, leading expert analysts to forecast a 10% drop during the coming month.

Events like travel companies halting, the postponed release of a new Bond film and uncertainty around the European championship football tournament this summer are likely to hit ITV revenues even further.

As the UK’s largest commercial broadcaster, it is thought that smaller ad-reliant hosts will mirror ITV’s current situation over the next few months.

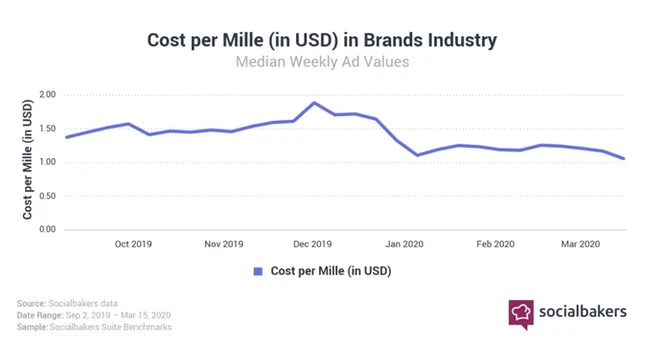

$0.81 decline in social ads CPM for brands

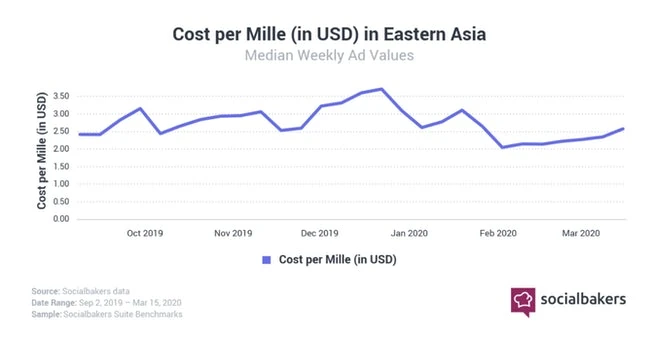

The average social ads CPM (Cost per thousand impressions) for brands is valued at $0.81 by analysis from SocialBakers. It is steadily declined since the beginning of the coronavirus outbreak. In November 2019, the CPM peaked at $1.88, twice the current value. Brands like consumer electronics and telecoms declined at the same rate during the first three months of 2020.

For the time being, the US is experiencing a very similar trend as it continues to fight the pandemic; average costs in East Asia have returned to roughly the same rate as they were seven months prior, reflecting the slow return to ‘business as usual in the region. While East Asia hasn’t seen the same peak in ad value as there once was towards the end of December (a CPM upwards of $3.50), it is likely to be seen as positive news for the ad industry there.

The rate of brand-safe covid19-related content is 60%

In order to avoid negative associations, many brands actively block keywords linked with viruses, such as quarantine pandemic coronavirus covid19. Still, according to GumGum’s machine learning-based analysis, up to 60% of online covid19-related content is brand safe. From 25th March to 6th April, around 2 million coronavirus-related pages were created, where 100k safe pages were added every day.

‘Business and finance’ was the highest category of 150000 unique safe pages, while ‘medical health’ and ‘news and politics’ ranked second and third throughout the period. Moreover, the largest percentage of unsafe pages are also introduced in these sectors compared to others. Over the course of several months, the top trending topic was covid19 in the content.

27.4% decline in the use of imagery in human interaction

Pattern89 study published on 24th March shows that there are 27.4% fewer videos and image ads of models exposed to viewing human interaction like shaking hands or hugging. It surveyed over 1100 advertisers and brands active on Instagram and Facebook.

Imagery featuring people washing faces or hands and videos and images that displays cleaning or water splashing has increased six times the regular rate since 12th March. In the same period, ads headline with ‘Sports and Fitness’ topics has tripled from 5.7% to 21%. In addition, in 39% of social ads, electronics like TV or smartphone are taken place.

Public relations and communications

Fake news about the pandemic

According to the Ofcom survey, half of the adults in the UK have been introduced to fake news about covid19. The three most circulated misinformation was drinking water might help to flush out the infection, gargling salt water could be an effective treatment and avoiding cold food and drink would help treat the virus; 35%, 24% and 24% of respondents read the news, respectively.

Only 7% of those had forwarded the information, 10% had used fact-checking services, and 15% had used fact-checking advice to know the reliability of the information. 55% of them ignored false claims actively.

47% of global consumers expect companies to support hospitals during covid19

It has been expected by 47% of consumers that companies should support hospitals with donation funds or production facilities to create equipment during the covid19 crisis. According to COVID-19 Barometer, consumers’ attitudes have changed after the second wave. They are starting to rely on useful items like practical advice. It has been claimed by almost a third of the consumers that they want companies to help them by providing advice about keeping fit and healthy at home or providing tips on how to relax.

When the pandemic ends, the brand will be remembered for its practical and helpful implications for consumers. Only 8% of consumers think about suspending advertising during this time, but the belief of creating distractions among people about the pandemic news by advertising is a significant number.

Entertainment

Netflix’s gain 16 million new subscribers

According to Financial Times, Netflix has targeted 7m subscribers for the period but became more than double with 15.8m new subscribers. Among them, 3.6m are Asian, and almost 7m are from the EMEA region. Compared to the same time of 2019, the rise in revenue was 28% in the first quarter of 2020, and it also reached $5.77bn while the forecast was $5.4bn by the company.

Although the brand has notified shareholders that with the decline of coronavirus outbreak, the membership will also decline, Netflix now wants to spend $1bn over the rest of 2020, which was lower than its initial estimation of $2.5bn.

Employment and recruitment

92% of marketers rate their organisations ‘pretty well’ or ‘very well’ equipped for remote working

Seven phases of GlobalWebIndex’s coronavirus research suggest that US and UK advertising, marketing, and PR industries are the ‘most ready’ for remote working.

In the advertising/marketing/PR industry, 92% of workers agreed that their organisations are ‘pretty well’ or ‘very well’ equipped to operate from a fully remote place. At the same time, 76% of workers agreed that the organisations in the tech/IT/software and the ratio of financial service workers was 69%. Mostly the believers are senior staff. Alongside organisations need stuff in physical settings sector, and healthcare believer is scored worst. Larger companies are facing more trouble with remote working, while companies with 250-2000 workers always remain ready for remote working.

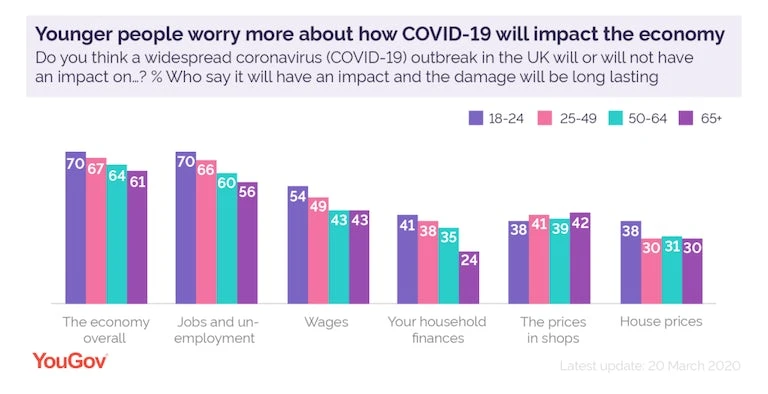

Worried 14-24 ages young generation

The young generation from 18 to 24 is mainly worried about the impact of the corona pandemic on the job market. YouGov published a new survey with 1619 adults in the UK on 24th March. According to a publication, seven in ten 18 to 24-year-olds found said they are worried about high unemployment for a long time as the effect of the coronavirus. 54% of 18 to 24-year-olds also believe that wages will be affected by coronavirus compared to 43% aged 50 and over.

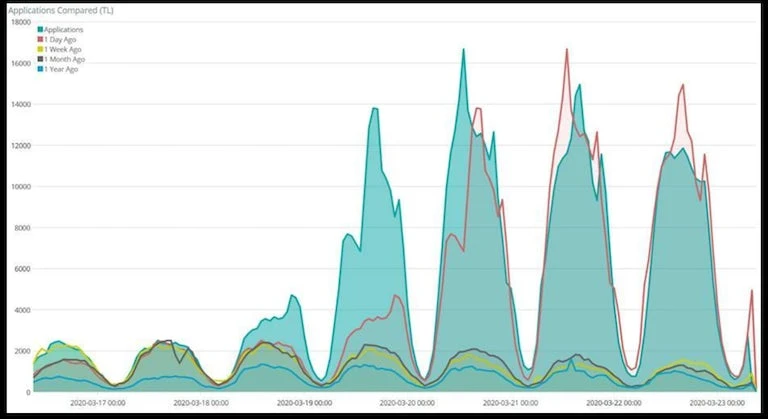

Rush in the job applications for retailers

Results are shocking in the sector of retailer’s application. A study from TribePad shows that the daily application rate of retail business increased more than 200000 per day from 5000 on Friday. On Saturday evening it was revealed that more than 300 applications in every minute after the supermarket’s urgent appeal for staff.

According to the survey application, workers have dropped by 23% in healthcare, 33% in hospitality and 73% in recruitment compared to the same period in 2019. During the same period, retail recruitment activity in fashion organisations was paused.

Social media

50% increase in Facebook’s messaging

Facebook published a blog post on 24th March outlining the usage of its massaging apps during this pandemic situation. According to it, over the last month, the total user massaging has increased by more than 50% in the countries the hardest hit by a coronavirus. Voice and video calling using WhatsApp and Messenger have more than doubled.

In Italy, live views on Facebook and Instagram doubled in a week, and people started spending 70% more time on Facebook when the crisis began. Time in the group calling increased by 1000% and messaging by over 50% in Italy last month.

45% of consumers spend more time on social media globally

Changes in consumer behaviour during the coronavirus, surveyed by GWI, reported that between 16th -20th March, 13000 consumers were conducted, and 95% of consumers spent more time on in-home media consumption. Meanwhile, a marked increase happens in watching new coverage; two in three consumers spent more time doing this activity.

Interestingly, almost 45% are allocating more time on social media, over 50% are viewing streaming services, 45% are spending time messaging, and over 10% say they are creating and uploading videos.

When asked if the brands should usually carry on advertising, over a quarter disagree, over a third agree and over a third are unsure. At the same time, 39% of the higher income group, 39% of men and 38% of Gen Z agree that advertising should continue as usual.

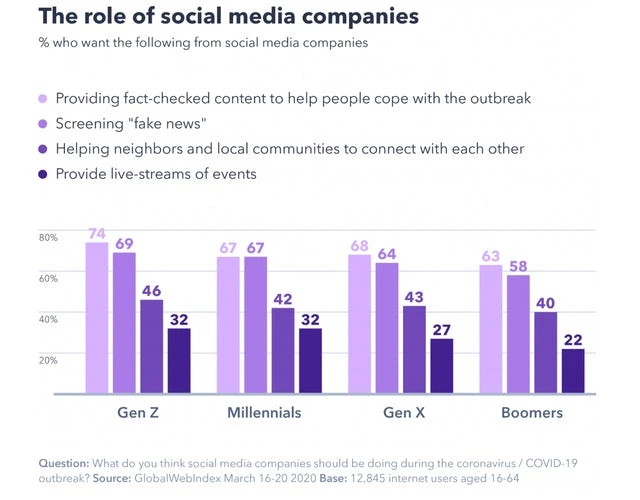

74% of Gen Z want fact-checked content from social media about covid19

According to a GWI survey, 74% of Gen Z globally believe there is a vital role of social media in proving fact-checked content during the coronavirus pandemic. 68% of Gen Xers, 67% of Millennials and 63% of Boomers agree with making social media the most desired feature of fact-checking content. WeChat users are the most insistent about fact-checking content.

40 to 46% of each age category agree to see this feature improved or introduced. Conspiracy theories and mass sharing being the most prominent issue, the chance of screening fake news by social media is the second most popular platform. During the isolation period, social media platforms could connect residents with local communities.

As much of the global population is missing out on cultural activities outside the home, they want live streaming to connect with local communities. One-third of Gen Z and millennials wish to live stream events from social media, dropping 22% for Boomers and 27% for Gen Xers. Younger Snapchat users are the most numbers who want live streams as part of the social experience during the pandemic.

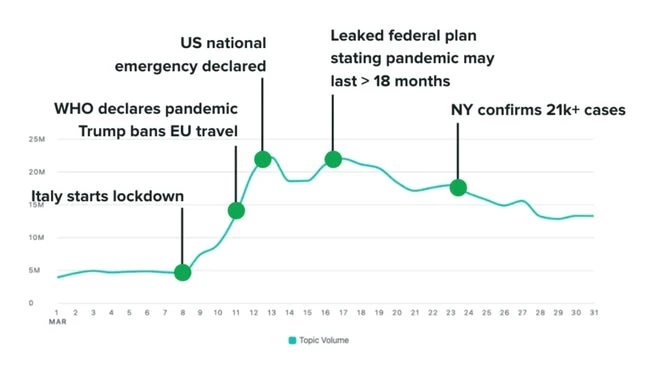

Twitter conversation about COVID19 quadrupled

SproputSocial study reveals that global Twitter conversation neighbouring the coronavirus pandemic quadrupled in March. Survey also found that global posts speared to 5-6 million after the hit of the US stock market, which remained at one million per day during February. As the US announced a state of emergency in mid-march, topic volume rose 20 million from around 5 million on the first day. Afterwards, coronavirus conversation continued to exist.

Approximately 13 to 20 million daily posts globally. As coronavirus gained attraction around 20th January after the first case appeared, the whisper about the virus took place on the platform from the beginning of the year. Events like the WHO declaration of the virus pandemic and the official quarantine of Wuhan city was the central topic contributing to the timeline.

After some time, coronavirus conversations shifted as people practised social distancing, and many households started to remain indoors. People began to share the impact on their daily lives, including discussions about homeschooling, distancing, and unemployment, respectively, 2111%, 1188% and 4725%. People are now mainly focusing on the practical situation.

At length, it can be said every term has both good and bad impacts. Coronavirus is in the same line. Some are facing challenges, and some are having good business. We must look into the changes and take the best decision for our field of work. Advertising, ecommerce and marketing are the areas where changes are eye tickling due to the pandemic. New strategies are a must here to build up an increase in the image. Stay home, stay safe, maintain social distancing and hope for the best.

![How to Start an Ecommerce Business in Australia [2023 Guide]](/template/5731a701/images/resource-blog-right-img1.png)